Analysts Say Buy These 2 Beaten-Down Stocks Before They Rebound

Old school investors will tell you that ‘buying low and selling high’ is the key to market success. The advice may be cliché, but it’s based on mathematical truth. The hard part, however, is understanding when prices are low, because that’s not always an absolute number.

In recognizing that lower price range, investors can turn to Wall Street’s pros for help.

Using TipRanks’ platform, we pinpointed two beaten-down stocks the analysts believe are gearing up for a rebound. In fact, despite their hefty losses over the past year, the two tickers have scored enough praise from the Street to earn a “Strong Buy” consensus rating. Let’s take a closer look.

DZS Inc. (DZSI)

The first beaten-down stock we’re looking at is DZS. This firm is an important supplier of network hardware, particularly equipment for broadband connectivity, along with cloud-based communications software, in the global markets. The company’s range of products and services includes wi-fi access points, residential and business gateways, mobile and optical edge solutions, and optical line terminals. In addition, DZS hosts customer support centers, and professional consulting services. The company is a leader in mobile transport and broadband access solutions for emerging upgrade cycle in 5G and 10Gig fiber-to-the-premises.

While DZS operates in a major business niche, the stock has fallen 52% from the peak value it reached last summer. Much of that decline came in recent days, when the company’s 4Q22 financial release showed revenues and earnings below the consensus estimates.

By the numbers, DZS showed a top line of $100.2 million for the quarter. This was up 2% year-over-year, but it missed analyst expectations by more than 12%. Worse, the company posted an adjusted net loss of 10 cents per share; this compared unfavorably to the 14-cent forecast, and to the 5-cent EPS profit registered in 4Q21.

Zooming out, we see that 2022 as a whole showed a top line of $376 million, up 7% from 2021, even though total orders fell y/y from $504 million to $441 million. At the bottom line, the year’s adjusted EPS came in negative, at a 15 cent loss for 2022, compared to the 32-cent-per-share profit in the prior year. Commenting on the negative results, management cited both the ongoing COVID and supply chain headwinds, as well as a strong US dollar that impacted overseas profits and currency exchange rates.

On the positive side, DZS has recently announced several important business wins, including the February 2 announcement of the selection of its Saber-4400 optical transport technology by Bonfire Fiber for provision of high speed broadband services. Also in early February, the company announced that its Velocity V6 system won the Business Intelligence Group’s Innovations Product Award, based on its ‘record-breaking performance capabilities.’

Assessing the company’s prospects, Northland Securities 5-star analyst Tim Savageaux thinks it is a good time to be loading up.

“We recently noted the potential for short term supply chain and potential Tier 1 spending driven headwinds for DZSI, which were evident in the company’s lower than expected Q4 bookings, revenue and outlook… Despite the lower short term outlook, we believe the major Tier 1 wins with the potential for further traction more than offset these concerns and also note very inexpensive valuation metrics heading in with the shares trading solidly under 1X revs at 0.7X revs. Thus, despite the short term losses we see a positive outlook for the shares heading into 2H23,” Savageaux opined.

Savageaux quantifies his ‘positive outlook’ with an Outperform (i.e. Buy) rating, along with a $17 price target that implies an upside of ~83% from current levels. (To watch Savageaux’ track record, click here)

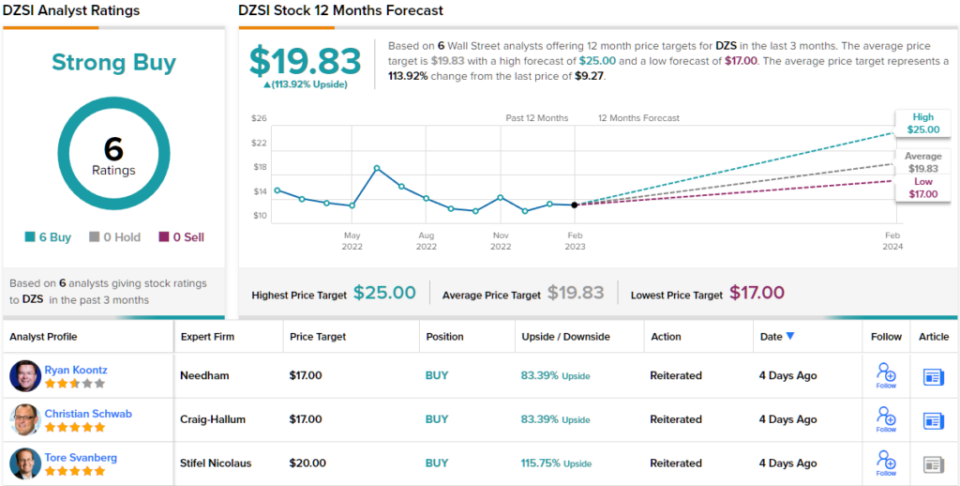

The rest of the Street supports Savageaux’s thesis. In fact, the average price target is even more upbeat; at $19.83, the figure is expected to yield 12-month returns of ~114%. The stock boasts a Strong Buy consensus rating, based on a unanimous 6 Buys. (See DZS stock forecast)

Upwork, Inc. (UPWK)

Next up is Upwork, an online freelance marketplace. Upwork, in its current incarnation, has been in business since its 2015 formation through the merger of oDesk and Elance. The stock peaked during 2021, when, during a year of volatile trading, it touched close to $60 per share several times. Since those heady days, however, the stock has been falling sharply, and in the past 12 months UPWK shares are down 52%.

While the stock has been falling consistently over the past year, last week saw a 15% drop in the wake of the 4Q22 earnings report. The company reported sound results – in fact, it beat the forecast on revenue and earnings. The top line came in at $161.44 million, against expectations of $159.29 million, while the bottom line of 4 cents EPS profit was well above the predicted 3-cent loss.

However, the company’s operating expenses have been rising this year, while y/y revenue growth has been slipping. And, Upwork’s forward guidance for Q1 and full-year 2023 both came in below the forecasts; for the quarter, the company guided toward $158.5 million at the midpoint, while analysts had expected $166.66 million, and the for the full year, the guidance midpoint of $697.5 was well below the forecast $720.22 million.

BTIG analyst Marvin Fong, who has been following Upwork over the long term, believes that the company has a basic resiliency that should see it through a difficult time.

“We think a couple of big-picture points are worth mentioning. UPWK’s secular tailwinds are bearing out as we still model 1% y/y GSV in 1Q23… Second, shares are trading at a 32% discount to Fiverr on a gross profit basis, a discount we believe is excessively large given the companies have fairly similar outlooks. Third, we don’t believe UPWK’s guidance embeds much for contract-for-hire, the lifting of the cap on connects, or a potential upturn in the economy. Last, we expect 1Q will mark the bottom in UPWK’s growth rate as compares ease and sales-force productivity ramps,” Fong explained.

Based on the above, Fong rates UPWK shares a Buy, and his price target of $20 implies a one-year upside potential of 70%. (To watch Fong’s track record, click here)

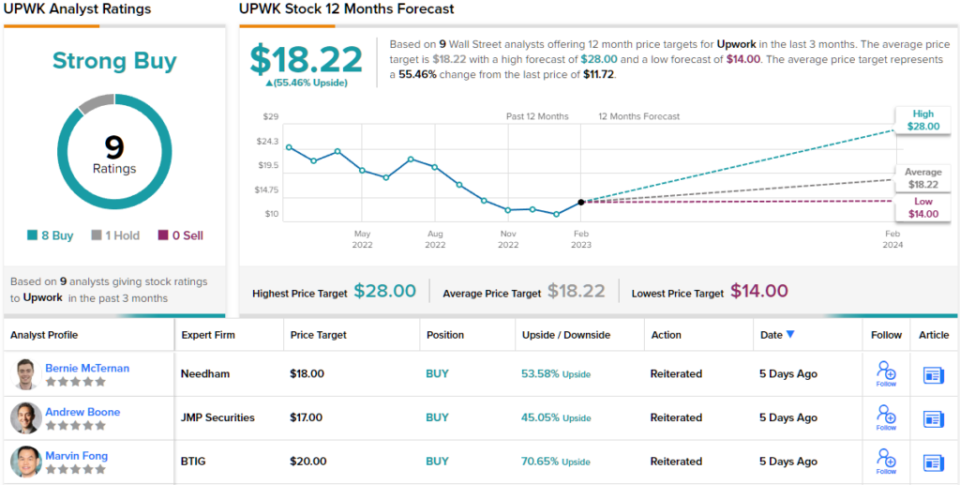

Upwork has definitely caught the eye of Wall Street, to the tune of 9 recent analyst reviews. These include 8 Buys against just 1 Hold (i.e. neutral), for a Strong Buy consensus rating. The shares have an average price target of $18.22, suggesting a 55% upside from the current trading price of $11.72. (See Upwork stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.