2 Shares Raymond James Says Are Completely ready to Surge 60% or Greater

Any one feeling dizzy from the latest industry gyrations? Volatility is back again on the menu in a large way. The earlier week noticed strong moves in the two instructions, with the bears in the end in regulate, culminating in Friday’s rout. Immediately after charging in advance for most of the 12 months, the main indexes have been on the backfoot not long ago, with the marketplace receiving jittery over Omicron variant fears and the Fed’s hawkish transform. Friday’s seemingly disappointing work opportunities report even more fanned the flames of question.

Nevertheless, even amidst the uncertainty, there are normally alternatives for buyers eager to request them out.

The analysts at Raymond James have picked out 2 shares which they believe are primed to jump bigger, on the buy of 60% or improved. We have utilised the TipRanks platform to glance up the most current knowledge on those people picks turns out the Street sees lots of upside much too.

Cushman & Wakefield (CWK)

So let us start off with a actual estate corporation. Cushman & Wakefield is a international participant in industrial true estate services, and is 1 of the world’s greatest these companies, with whole revenue past 12 months of $7.8 billion. The company’s earnings is supported by a big part of yearly recurring costs, but it is also uncovered to industry cyclicity. As a final result, the inventory is much more probably to get throughout the bull runs than much more steady investments such as true estate expenditure trusts.

Year-to-date, C & W shares have obtained 27%, outpacing the S&P’s 21% attain. The share gains have come as the best line has risen steadily by the yr. Revenues in Q1 were reported at $1.9 billion in Q3, revenues arrived in at $2.3 billion, also symbolizing a gain of 20% yoy. Of the total quarterly profits, $1.7 billion was incurred from fees, up 28% from the prior yr. EPS for the third quarter was 34 cents, down from 50 cents in Q2 but up dramatically from the 4 cents reported in 3Q20.

Cushman & Wakefield is usually on the lookout to develop in creative directions, and in October of this year the corporation introduced a partnership with WeWork, the flexible shared workspace corporation. The partnership features an expense by C & W of $150 million, and Cushman will be capable to leverage leasing and venture administration to make new profits streams.

Also in October, Cushman entered a joint enterprise with the commercial actual estate finance firm Greystone. The enterprise will see Cushman set $500 million into Greystone’s Agency, FHA, and Servicing corporations, for a 40% stake.

Covering CWK for Raymond James, 5-star analyst Patrick O’Shaughnessy writes, “We perspective Cushman’s recent valuation to be extremely attractive equally on an absolute and relative foundation, and we glance for its pending expenditure in multifamily origination company Greystone and partnership with WeWork as opportunity catalysts.”

O’Shaughnessy goes on to add that, “… despite an unclear medium-phrase outlook for office home demand, a rebounding worldwide economic system is driving brokerage exercise better and pointing in direction of additional upside in 2022 and over and above.”

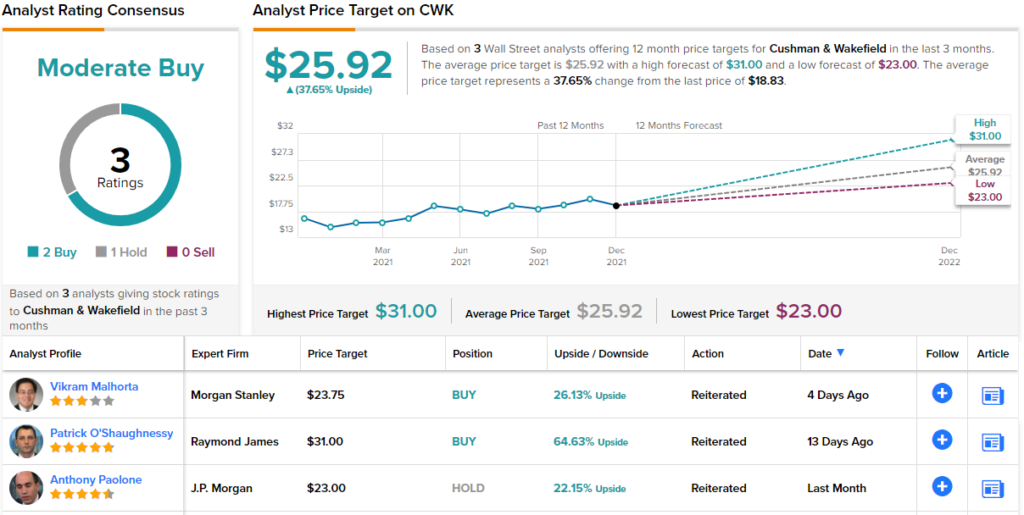

In line with these responses, the analyst upgraded his watch of the stock from Outperform to Sturdy Invest in, and established a $31 value concentrate on that indicates an upside of 64% for the year ahead. (To look at O’Shaughnessy’s keep track of document, click on below.)

This inventory retains a Reasonable Buy score in the Street’s consensus perspective, primarily based on 3 latest evaluations that contain 2 Buys and 1 Maintain. The regular price tag focus on of $25.92 suggests a prospective for 38% progress from the present share rate of $18.83. (See Cushman & Wakefield’s inventory assessment at TipRanks.)

LianBio Sponsored ADR (LIAN)

The next stock we’ll glance at is a Chinese biotech agency, LianBio. Not like a lot of other clinical-phase biotech researchers, this organization is looking into a assorted portfolio of new medicines in a huge variety of fields. LianBio has clinical trials ongoing in the fields of respiratory, inflammatory, and cardiovascular illness, as nicely as in oncology and ophthalmology. The programs are carried out in partnerships with other entire world-class biopharma businesses.

The three top packages in LianBio’s pipeline are in the places of oncology, cardiovascular illness, and ophthalmology. The leading cardiovascular program is for mavacamten, to start with formulated by Myokardia/Bristol Myers. Mavacamten accomplished a prosperous Stage 3 demo for the cure of obstructive hypertrophic cardiomyopathy (HCM) in the US and a Chinese Phase 3 trial is set to go forward throughout 1Q22.

Infigratinib qualified prospects the oncology application, indicated as a new treatment for gastric most cancers and other good tumor malignancies. LianBio is operating with BridgeBio Pharma on the clinical trials, and has three scientific tests ongoing. The drug has by now been accredited in 2nd line cholangiocarcinoma in the U.S.

The company’s most advanced system in ophthalmology is for TP-03, which was formulated by Tarsus Pharmaceuticals for the eye disease demodex blepharitis. Lian-Bio has manufactured an agreement with Tarsus for development and commercialization rights in China for the drug.

LianBio entered the US marketplaces by an IPO on November 1 of this calendar year. The shares opened at $16 each, exactly in the center of the predicted vary, and the organization lifted $325 million on the sale of 20.31 million American depositary shares. Shares have built an inauspicious start, sliding by 26% given that the initial day’s closing rate.

Having said that, Raymond James analyst Dane Leone sees the three primary investigate systems – and specifically the mavacamten system – as essential keys to LianBio’s forward potential clients. He outlines a few details for investors to take into account: “1) LianBio has a tiered assortment of assets with a few considerably de-risked drug candidates together with mavacamten, TP-03, and infigratinib 2) the organization stands to quickly improve revenues beginning 2025 with the envisioned approval of mavacamten, our projected main income driver and 3) the enterprise has a diversified group of licensing partners, which grants it flexibility to go after optimistic medical results whilst not relying also seriously on one particular indicator or drug course.”

Regarding mavacamten, Leone is bullish on the company’s capability to commercialize, crafting, “[LianBio] stands to get started gathering income for the duration of 2024 at $45M with a phase up to ~$320M in the course of 2025.”

These reviews back up Leone’s Outperform (Obtain) ranking on the stock, and his $27 cost target indicates a huge upside of 168% from the recent share selling price of $15.57. Leone’s is the first overview on file for this biotech inventory. (To enjoy Leone’s observe report, click on below.)

Other analysts see a good deal of upside way too heading by the $24.4 typical focus on, shares are anticipated to increase by 142% around the coming months. With 2 further Purchases vs. 1 Maintain, the inventory features a Sturdy Obtain consensus ranking. (See LianBio’s stock analysis at TipRanks.)

To uncover good suggestions for shares buying and selling at appealing valuations, pay a visit to TipRanks’ Greatest Stocks to Acquire, a newly released instrument that unites all of TipRanks’ equity insights.

Disclaimer: The views expressed in this article are entirely these of the highlighted analysts. The written content is supposed to be applied for informational uses only. It is very critical to do your very own analysis right before earning any financial investment.